Contact Center Review

Contact Center Review, an initiative by Novistra Capital, is a curated quarterly newsletter to keep you updated about the Contact Center Industry. In our second edition of the year, we bring you trends and insights, along with select M&A transactions during Q2 2021.

The US contact center industry served organizations through remote working conditions and invested in automation during the Covid-19 pandemic. While all other industries continue their struggle to conform to the new normal, contact centers have adapted the new environment and embracing multi-source models to mitigate dependencies and prepare for any future black swan events. Organizations that scaled down to cope with the economic downturn have now started ramping up with dedicated hires for critical functions. They are also partnering with industry specific contact centers that have domain centric expertise to sustain business productivity.

Contact centers are gravitating towards automation to reduce labour-intensive and mundane tasks.

The use of Artificial Intelligence (AI) powered voice services, chatbots and IVR, for both inbound and outbound services, are becoming the norm. Also, increasing number of companies are migrating to the cloud considering remote working, risk mitigation and the efficiency associated with cloud environments. As retail/consumer focused brands expect a demand uptick in H2 2021, contact centers are offering multichannel digital marketing solutions to optimize sales ROI and enhance customer experience.

The contact center industry reported stable M&A activity in Q2 2021. Strategic investors pursued acquisitions to enhance service capabilities and expand into new verticals/markets. The industry witnessed a mega deal, in which, US-based Sitel Group acquired Sykes Enterprises (NASDAQ: SYKE) for approx. $2.2 billion in a call-cash transaction. We expect demand for corporate outsourcing and digital transformation to drive M&A activity in the second half of the year.

Upcoming Industry Events

About Novistra

Novistra Capital is a boutique M&A and PE advisory group with a strong focus on the Contact Center Industry. Founded in 2010, Novistra has a team of experienced professionals, located across 4 offices in the US, UK and India. Please contact the following members of the Novistra team to discuss strategic options for your company.

Ripun Jai Mehta

Managing Partner

ripun.mehta@novistra.com

(646) 645 1935

Pankaj Arora

Managing Director

pankaj.arora@novistra.com

(917) 460 0659

Peter X. Li

Managing Director

peter.li@novistra.com

(917) 250 8605

Anuj Jaisinghani

Vice President

anuj.jaisinghani@novistra.com

(437) 234 1151

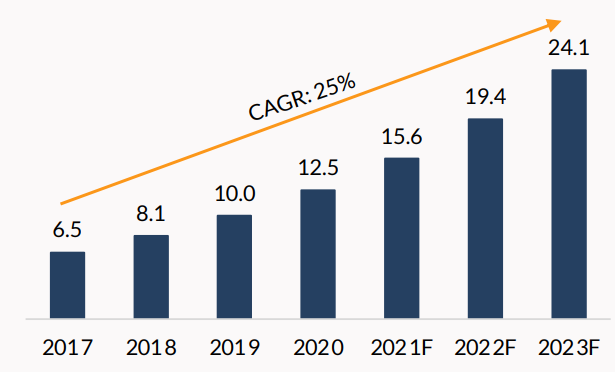

Contact Center: Sustained Long Term Market Growth

Rapid advancements in technology, be it Cloud, AI, Robotic Process Automation (RPA)/ Chatbots, complimented with omnichannel communication, has transformed contact centers. The Covid-19 pandemic shifted the industry to remote working conditions, which compelled contact centers to switch to cloud, at an unprecedented pace, for better performance and information storage. Currently, nearly 65% of the industry is cloud-based. Cloud-based contact centers give organizations the flexibility and agility to serve more customers. Considering the efficiency gains and cost savings associated with this set up, we expect this trend to continue shaping up the way the industry operates post pandemic.

Traditional contact centers, which relied on voice processes for demand generation, are now actively deploying digital solutions with a multichannel approach to improve sales ROI and enhance customer experience. Digital marketing strategies such as WhatsApp, Facebook, LinkedIn, PPC etc. are getting increasingly popular in a period where human interactions have become limited and digital technologies have overtaken social lives.

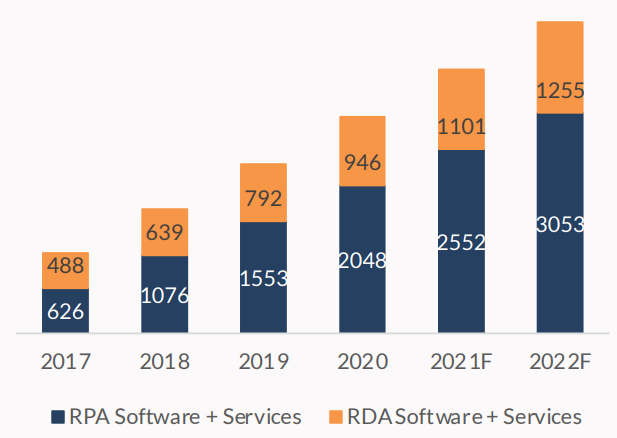

RPA is being deployed across contact centers to boost efficiency and overcome employee redundancies. The implementation of RPA has streamlined operational processes, including integration of data across numerous in a templatized manner. This has resulted in higher contribution margins, leading to better yields for shareholders and investors. AI is being used by contact centers to enhance customer support services. Constant improvements in AI abilities has evolved it into recognizing customer sentiments in real-time, assisting with the need for redirection or human intervention, if needed. AI is expected to continue making significant contributions in terms of digitizing contact centers.

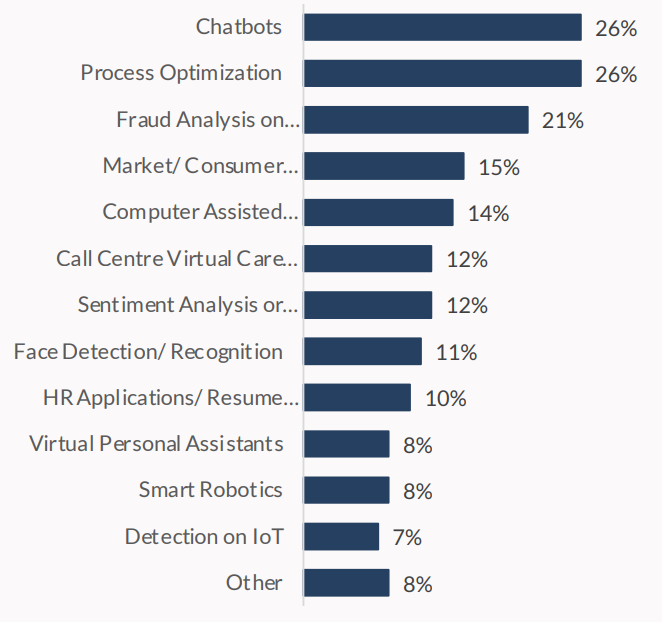

Increasing number of contact centers are utilizing chatbots to address simple and common inquiries. As the pandemic has accelerated the shift to greater automation, organizations are using more AI-powered bots for enhancing efficiency and as well as bringing “empathy” for basic interactions. Chatbots currently lead amongst the use cases of AI globally. Organizations that made use of chat and AI bots less than 10% of the time, are experiencing their usage surge to ~25%, and expecting this to touch ~35% by the end of 2021. Chatbots could replace human agents over time, with rapid innovation, as AI gets better at predicting and optimizing contact center processes.

Global Cloud Contact Center Market

(in $Bn)

Global RPA market to reach $4 billion by 2022

(in $Mn)

Chatbot leads in use cases of AI (%)

Select M&A Transactions in Q2 2021

*All figures in $ millions

Select M&A Deals in the Contact Center industry

Sitel Group, a leading provider of customer experience (CX) products and solutions, announced the acquisition of Sykes Enterprises Incorporated (NASDAQ: SYKE), a full life cycle provider of global CX management services, multichannel demand generation and digital transformation solutions. Sykes and its subsidiaries provide CX management solutions and services to Global 2000 companies and their end customers, primarily in the sectors: financial services, technology, communications, transportation & leisure and healthcare. A subsidiary of Sitel Group will acquire Sykes for approximately $2.2 billion and Sykes will become a private company and its shares will cease trading on NASDAQ.

This acquisition allows Sitel Group to enhance its CX products and solutions within EXP+™, especially with the addition of Sykes’ CX solutions in digital, social media and RPA, through its suite of digital transformation capabilities, including Clearlink and Symphony. Following transaction closure, the combined company will generate revenues of over $4 billion in 2021 and will employ 155,000 employees across global offices in 39 countries, serving 600+ clients in over 50 languages.

Connect acquired customer care and IT solutions provider, ServiceCX for an undisclosed amount. Connect, a UK headquartered company, was launched in July 2019, following a merger of Connect Managed Services and G3 Comms. ServiceCX specializes in market leading customer experience technologies and services such as Calabrio WEM, ServiceNow CSM and Five9 cloud contact center. ServiceCX also provides omnichannel customer service management, workforce optimization and cyber protection services.

Connect will leverage ServiceCX’s contact center and customer service experience to strengthen its capabilities. The transaction will strengthen Connect’s global client portfolio, which includes a broad range of public sector and private sector organizations, such as banks, financial services, retailers, manufacturers, media, healthcare and pharmaceutical companies. This acquisition comes less than a year after Connect added ICR Speech solutions and services to leverage its virtual agent and speech application offerings.

Berlin based Perpetua Holdings acquired a majority stake in Nothelle Group, from its founding family. Perpetua Holdings invests up to $120 million on a long-term basis into solid small and medium sized business in Europe. The Nothelle Group, which includes Nothelle Call center Services Gmbh and Nothelle Outsourcing Services Gmbh, is a contact center offering technical support, customer acquisition and retention and remote support. Nothelle employs 600 agents and caters to blue chip customers and SMEs in Germany, Austria and Switzerland. Financial terms of the transaction were not disclosed.

The investment from Perpetua will assist the shareholder and management team of Nothelle to accelerate the organic growth of the company, fund inorganic growth opportunities and expand the service portfolio. Maurice Nothelle, the company’s promoter will continue to serve as the CEO.

Human resources company, Eurofirms Group, acquired Norley, a Madrid based company specializing in telesales. Inneria, which is a part of Eurofirms Group, has nearly two decades of experience in outsourcing services, including contact center services for multiple sectors. Norley provides teleservices, including call issuance, reception services, lead management, CRM and consulting services through its contact centers in Spain. Financial terms of the deal were not disclosed.

With this acquisition, Eurofirms wants to strengthen its position as one of the leading Spanish human resources companies in the country. Norley will be integrated with Inneria, which aligns with Eurofirms strategy of investing in technology and focusing on customer service.

Post the integration, Eurofirms will have four contact centers in Spain: two in Madrid and two in Langreo. Eurofirms will incorporate Norley’s staff of 100 professionals and hire 300 customer service employees to provide coverage to the financial and consumer sectors.

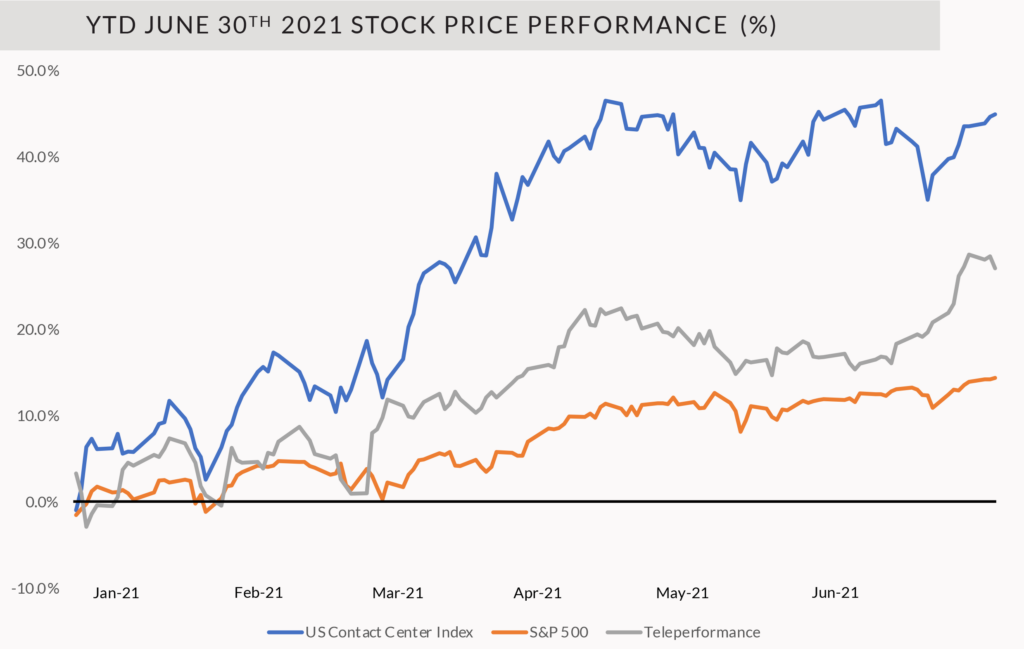

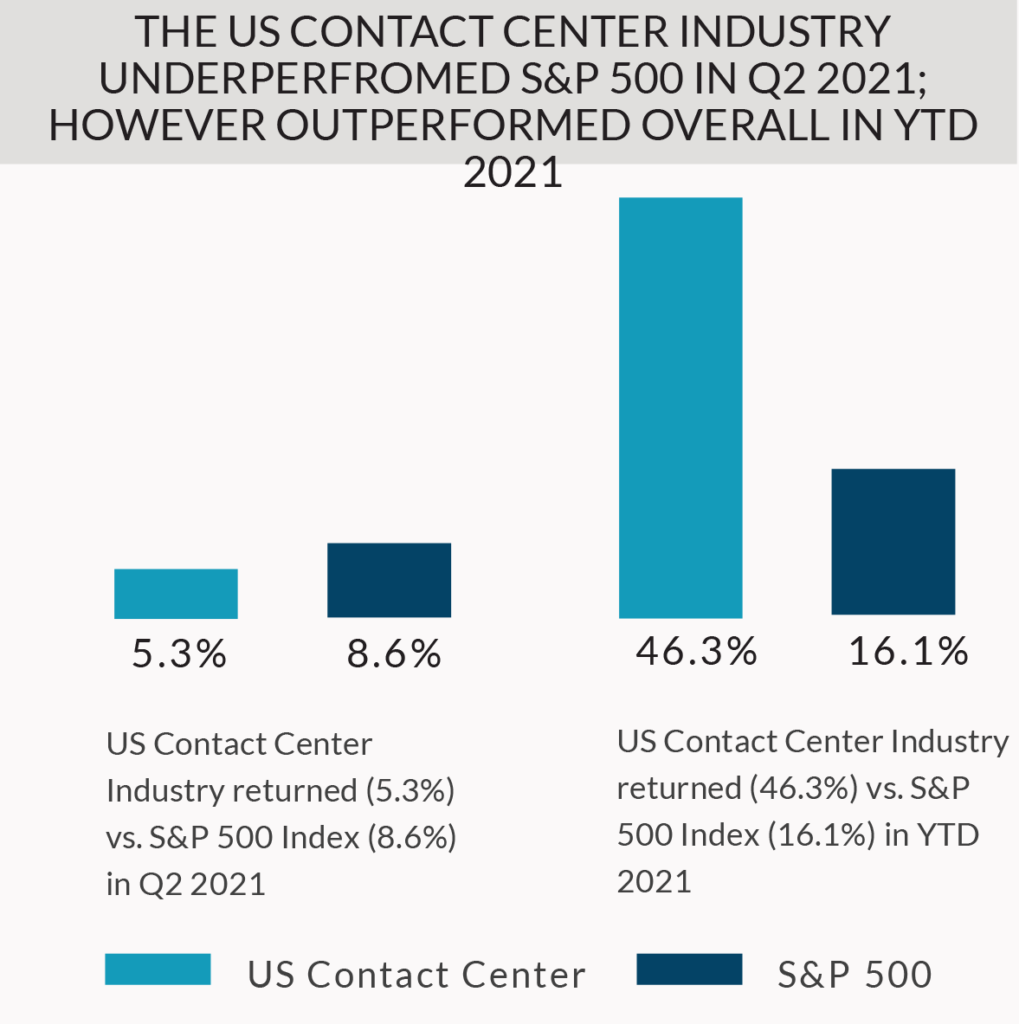

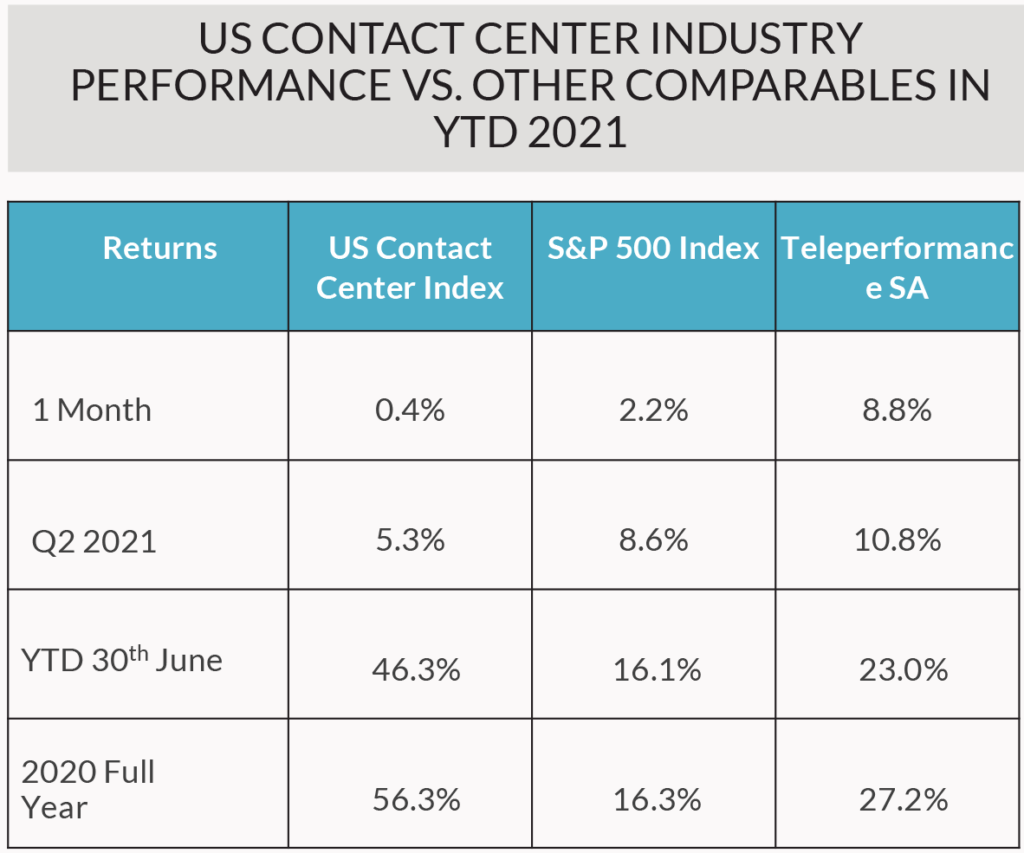

The US Contact Center Industry trailed the S&P 500 Index in Q2 2021

*US Contact Center Industry Index is the market capitalization weighted index comprising of companies: TTEC Holdings, Sykes Enterprises Inc., Atento S.A, SYNNEX Corp, IBEX Ltd., and StarTek Inc.

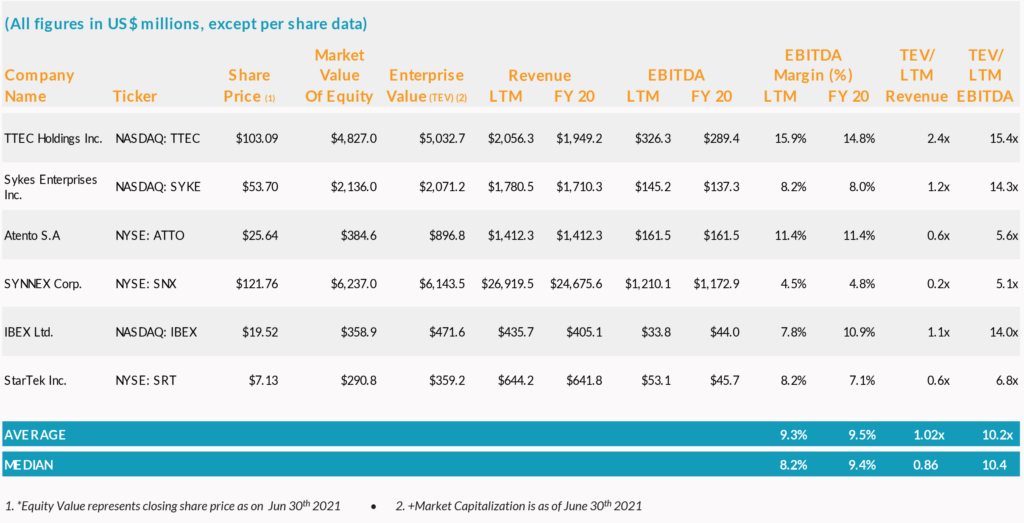

Public Comparable Company Analysis – US Contact Center Industry

Disclaimer:

This document is intended solely for the use of the party to whom Novistra has provided it and is not to be disclosed (in whole or in part), summarized, reprinted, sold, redistributed or otherwise referred to without the prior written consent of Novistra. All references to “Novistra” refer to Novistra LLC. In the normal course of its business, Novistra seeks to perform consulting and other fee generating services for companies that may be the subject of Novistra’s research reports. Information presented in this document is for informational, educational and illustrative purposes only. While the information in this document is from sources believed to be reliable, Novistra makes no representations or warranties, express or implied, as to whether the information is accurate or complete and Novistra assumes no responsibility for independent verification of such information. Facts and views presented in this document have not been reviewed by, and may not reflect information known to, professionals of other Novistra business areas. In addition, the analyses in this document are narrowly focused and are not intended to provide a complete analysis of any matter. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or for any distribution or use that would subject Novistra or its affiliates to any registration requirement within such jurisdiction or country.

Recent Comments