Leadership

Ripun Jai Mehta

MANAGING PARTNER

Ripun Jai Mehta is the Founder and Managing Partner at Novistra. In his dynamic 20 plus year career in financial services, Ripun has closed 50 M&A and PE transactions, advising global multinationals across the healthcare, ... media, education and technology industries. Ripun leads the firm’s global cross-border M&A practice and specializes in the technology and IT enabled services sector. Complementing his experience in finance is Ripun’s track record as a serial entrepreneur and investor. Apart from Novistra, Ripun has co-founded two companies in the creative space, 5By7 and ArtNouv, and was a co-founder at Kyma Capital, a London based investment fund. Ripun graduated with an MBA from the London Business School, where he was a Sumantra Ghoshal Scholar. Ripun is based in London and spends his time between London and New York, where he was previously based for over a decade.

Read More | ripun.mehta@novistra.com

|

ripun.mehta@novistra.com

|

Pankaj Arora

MANAGING DIRECTOR

Pankaj Arora is a Managing Director at Novistra with over 18 years of experience in investment banking, private equity and corporate strategy. Prior to Novistra, Pankaj worked with SNSK, a $500mn private equity fund, ... where he was involved with several transactions in the US healthcare technology and services industry.

Read More | pankaj.arora@novistra.com

|

pankaj.arora@novistra.com

|

Peter X. Li

MANAGING DIRECTOR

Peter Li is a Managing Director at Novistra with more than 16 years of investment banking experience (over 35 completed transactions) in a variety of industries across the Americas, Europe and Asia. ...

Prior to Novistra, Peter was a senior banker with Moelis & Company’s (NYSE:MC) highly regarded global Real Estate, Gaming, Lodging & Leisure group, where he advised operating companies, real estate investors, and hospitality technology companies. Selected transactions include – represented Aimbridge Hospitality, the world’s largest hotel management company, on multiple transactions; helped form Two Roads Hospitality through a merger between Destination and Commune Hotels, and advised on its subsequent sale to Hyatt; represented Kokusai Kogyo, one of the largest Japanese conglomerates, on its acquisition of full interest in Kyo-ya Hotels from Cerberus; advised Starwood Waypoint Homes on its $7.7bn public merger with Colony American Homes, which solidified single family rentals as an institutional asset class in the U.S.; guided Revel Atlantic City, a $2.4bn mega resort, through a complex Section 363 bankruptcy sale process.

During the recent travel disruption, Peter was a trusted negotiator in several high-stake situations and advised several boards on critical capital allocation and growth decisions. At Novistra, Peter also leads advisory for family/founder-owned enterprises for North America.

Peter received his BA from Claremont McKenna College, where he serves as a Kravis Leadership Institute Fellow and a Financial Economics Institute Associate. He earned his MBA from London Business School.

peter.li@novistra.com

|

peter.li@novistra.com

|

Vipul Bhargava

MANAGING DIRECTOR

Vipul Bhargava is a Managing Director at Novistra with over 10 years of experience in the global education industry. Vipul co-founded Novistra’s education practice out of London, leveraging his deep expertise

...

in the sector as the Founder and CEO of GILT Education, an education-focused consulting firm that specializes in cross-border organic growth of education companies.

vipul.bhargava@novistra.com

|

vipul.bhargava@novistra.com

|

Ash Mittel

MANAGING DIRECTOR

Ash Mittel is a Managing Director at Novistra. Ash has over 20 years of international experience working for a number of leading global blue-chip companies including RELX Group, PwC and Goldman Sachs....

Read More | ash.mittel@novistra.com |

ash.mittel@novistra.com | Guy Israeli

MANAGING DIRECTOR

Israeli is an experienced tech entrepreneur and finance professional having spent 15+ years in building ventures as an entrepreneur, a VC professional and as an investment banker.

...

Guy has been active in the venture space across various emerging and developed markets and became an expert of building global ventures.

guy.israeli@novistra.com

|

guy.israeli@novistra.com

|

Nachi Das

MANAGING DIRECTOR

Nachi Das is a Managing Director with Novistra and a seasoned finance professional with 25 years of experience in capital markets in Asia, Europe and the US. His expertise encompasses several areas of investment,

...

financing, private equity, structuring, portfolio management and risk management in some of the largest financial institutions.

nachi.das@novistra.com

|

nachi.das@novistra.com

|

Anuj Jaisinghani

VICE PRESIDENT

Anuj Jaisinghani is a Vice President at Novistra, with over 6 years of experience in investment banking and consulting. Prior to Novistra, Anuj worked for KPMG where he was involved with transactions

...

across various sectors focused on the UK market.

anuj.jaisinghani@novistra.com

|

anuj.jaisinghani@novistra.com

|

Radima Khatataeva

VICE PRESIDENT

Radima is a Vice President at Novistra Capital with over 10 years of experience in both the public and private markets. She has previously worked at Ardent Advisors...

focusing on deals in the digital transformation space.

radima.khatataeva@novistra.com

|

radima.khatataeva@novistra.com

|

Aditi Khandelwal

SENIOR ASSOCIATE

Aditi Khandelwal is a Senior Associate at Novistra.

She assists the team across the technology, IT enabled services, and education industries. Prior to Novistra, ...

Aditi worked at Ernst & Young.

aditi.khandelwal@novistra.com

|

aditi.khandelwal@novistra.com

|

Kunal Sharma

SENIOR ASSOCIATE

Kunal Sharma is a Senior Associate at Novistra, with over 5 years of experience in private equity and investment banking. He assists the team across the technology, IT enabled services and events / exhibition industries....

Prior to Novistra, Kunal worked at EPIC Investment Partners, a UK-based private equity firm.

Kunal graduated with an MSc. Finance from Trinity College Dublin, Ireland. He completed CFA level III in June 2018 and is a CAIA Level II candidate. Kunal is based in New Delhi, India.

kunal.sharma@novistra.com |

kunal.sharma@novistra.com | Tushar Chidamber

ASSOCIATE

Tushar Chidamber is an Associate at Novistra with over 5 years of experience across credit risk, consulting and corporate development. He assists the team across the technology, IT enabled services, education and events/... exhibition industries. Prior to Novistra, Tushar worked at Finablr, a Middle East based global foreign exchange and fintech group, and Deutsche Bank.

Tushar is a MSc in Applied Finance graduate from Singapore Management University and holds an undergraduate degree from BITS Pilani, India. Tushar is based in New Delhi, India.

tushar.chidamber@novistra.com |

tushar.chidamber@novistra.com | Mohit Kamra

Associate

Mohit Kamra is a Associate at Novistra with over 3 years of experience across valuations, financial modeling and research. He assists the team across the technology, IT enabled services and BPO/ KPO industries....

Read More | mohit.kamra@novistra.com |

mohit.kamra@novistra.com | Vignesh Ram Hariharan

CHIEF OF STAFF & LEGAL COUNSEL

Vignesh is the Chief of Staff and Legal Counsel at Novistra with over 6 years working experience in Corporate Legal, HR and Marketing. ...

Read More | vignesh.hariharan@novistra.com |

vignesh.hariharan@novistra.com | Kirti Verma

ANALYST

Kirti Verma is an Analyst at Novistra Capital. Kirti is a Finance Graduate from University of Delhi and is based out of New Delhi, India. ...

Read More | kirti.verma@novistra.com |

kirti.verma@novistra.com | Thimmaiah S

ANALYST

Thimmaiah S is an Analyst at Novistra, with over 2 years of experience in corporate development, investment banking, and early stage investing. ...

Read More | thimmaiah.s@novistra.com |

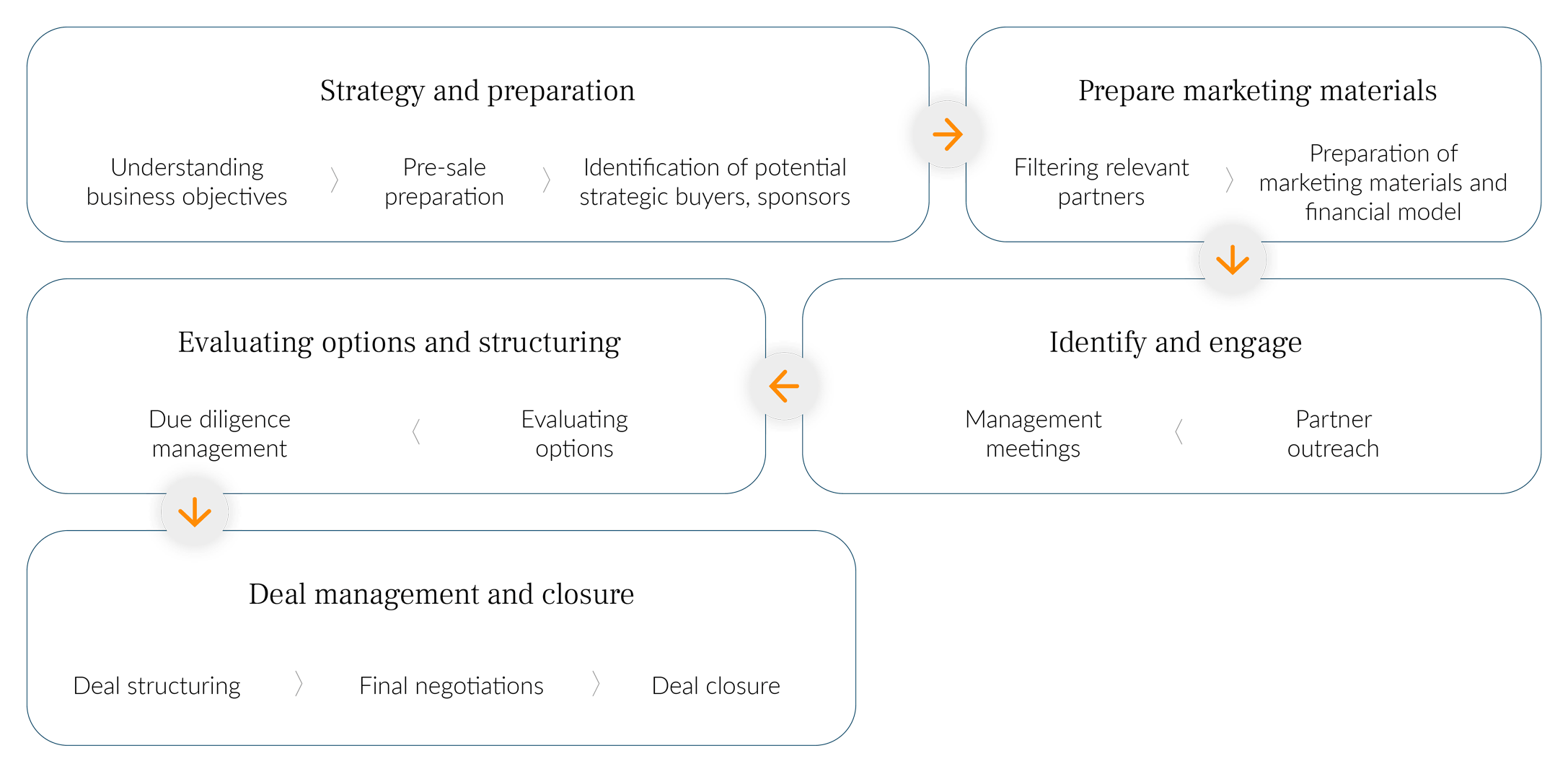

thimmaiah.s@novistra.com | Sell-side

Novistra works closely with entrepreneurs and business owners to help them maximize their shareholder value by conducting a structured exit. We place paramount importance in running a discrete and effective process. Our team understands the journey of an entrepreneur, and the considerations faced by business owners, and we aim to comprehensively guide clients through the process of exiting a venture. Over the years Novistra has built strong relationships with a wide range of strategic and financial buyers in our chosen industries. Sellside clients gain valuable exposure to Novistra’s global networks to identify potential acquirers and achieve strategic exits.

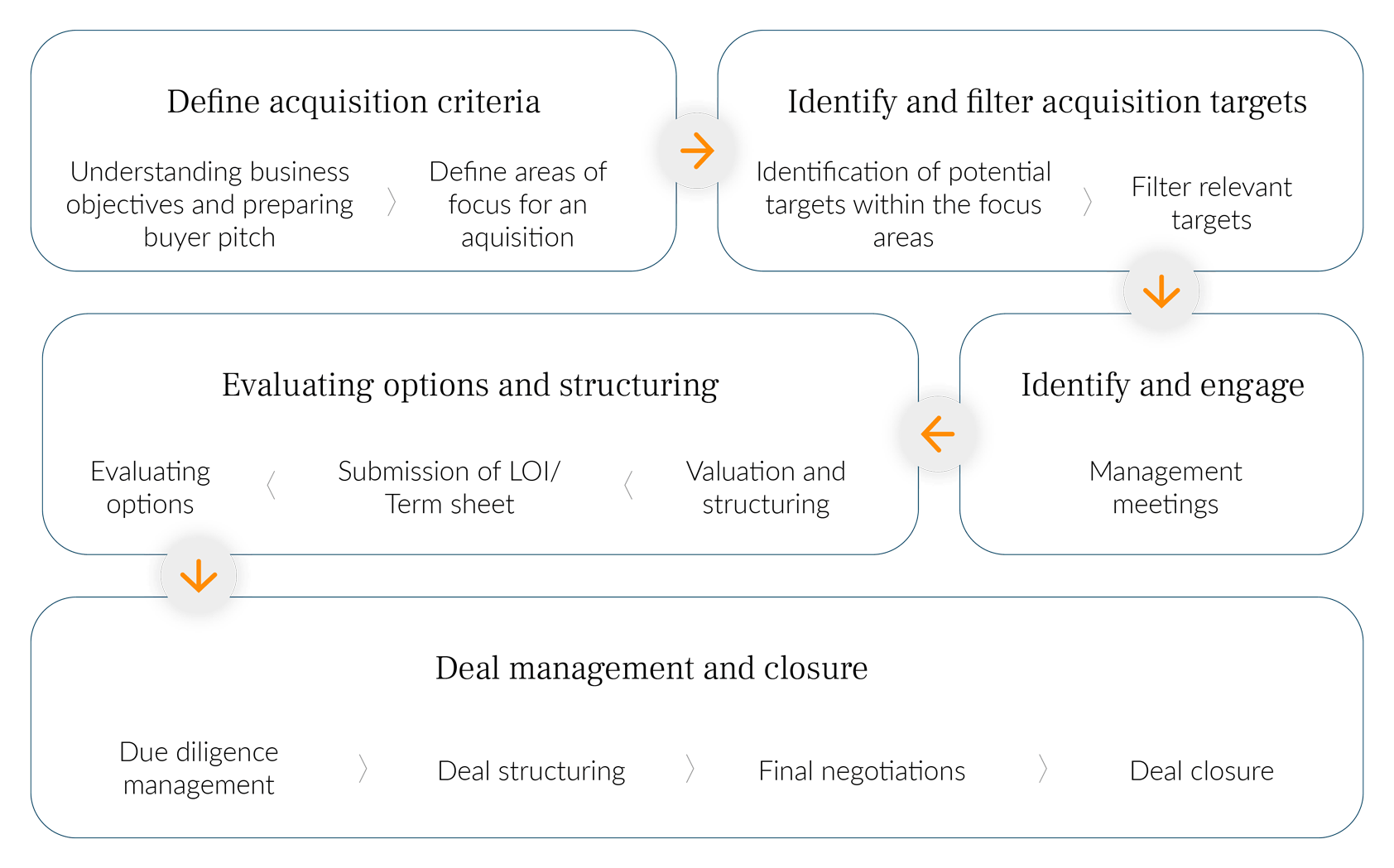

Buy-side

Novistra provides clients guidance on the best strategies to accomplish inorganic growth, be it through acquisitions directed at expanding product lines, services, gaining a foothold in new geographies, or positioning companies for new opportunities. We partner closely with client management and M&A teams, introducing strategies and acquisition targets that can help create and amplify business synergies, boost top line revenues and reduce costs. While we advise on a client’s immediate growth objectives, we keep our focus on positioning clients to achieve goals and maximize shareholder value over the longer term.

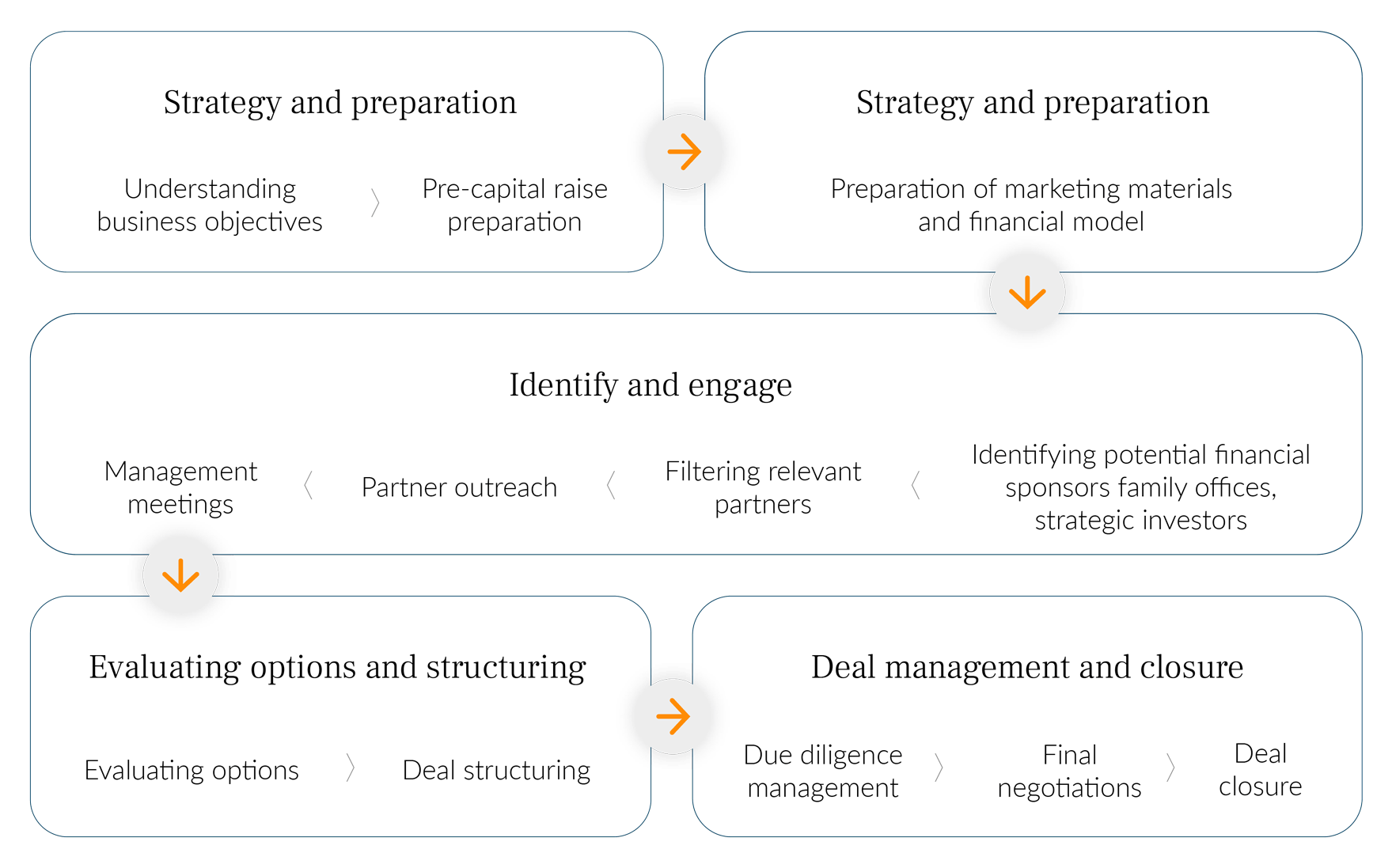

Growth Capital

Whether the goal is financing organic or inorganic growth plans, or financing a new phase of commercialization, Novistra partners with clients to raise capital from investors that are strategic and complementary to our clients’ business and values. A deep understanding of client needs and our priority industries drives bespoke strategies to identifying equity and debt finance sources which respond to the size of the financing required, the type of transaction, and geographic or regional preferences. Capital raises led by Novistra leverage a depth of experience at every step of the transaction, resulting in a thorough process and ultimately the right investor to help clients advance to the next stage of business goals.